Get in touch

- Phone:

- 04 473 7224

- Email:

- info@wecc.org.nz

- Postal Address

- PO Box 1087

Wellington 6140 - Head Office:

- Level 13, NTT Tower, 157 Lambton Quay, Wellington 6011

The Wellington Chamber of Commerce and Business Central ('the Chamber') is a business membership association, representing around 1,000 organisations in Wellington and throughout Central New Zealand (Gisborne to Taranaki and down to Nelson). We have represented business in the Wellington Region for over 165 years and work with a range of organisations to help them network, share ideas and experiences, learn and develop, represent their interests to local and national government, provide employment relations support, and help with export and growth opportunities.

The Chamber works closely with the Wellington City Council (WCC) to ensure Wellington’s business community is consulted on the changes that impact them. We seek to play a constructive role in the future development of our city and would like to thank the Council for the opportunity to submit our thoughts on Tō mātou mahere ngahuru tau – the 2024 - 2034 Long-term Plan. We welcome the opportunity to discuss our submission further.

We would also like to acknowledge the interest of the Mayor and Chief Executive of WCC in our kawenata with the Te Awe Māori Business Network and the Wellington Pasifika Business Network. The relationship between the organisations is founded on shared values and a genuine belief that the business community is stronger by working together. The partnership joins the Chamber with Māori and Pasifika business networks in the city and draw on the strengths of our combined voices: ‘The Power of Three.’

Wellington businesses are committed to the success of our capital, yet they feel systemically undervalued and underrepresented. The Long-term Plan (LTP) serves to underscore this.

Business confidence in the council is at a low point. Given some of the options in this LTP and recent council decisions, such as:

Consideration of the sale of the airport shares

Water meters

Targeted rates for rubbish collection

An external observer

A business advisory group

Infrastructure investment, and

Prudent fiscal management

A visitor to the city may arrive at the conclusion that this is a business friendly council.1

However, this LTP has arrived against a backdrop of activity and decisions that means businesses struggle to trust the council, do not have confidence in its decision-making capability, and do not have confidence in its ability to manage the finances of the city moving forward.

The Chamber has consistently been calling for greater budget restraint for a long time. The Wellington Report set out a view on what Wellington needs, and our other research has shown the negative impacts of continuing to rate businesses at a high rate. We welcome the steps that have been taken, but strongly believe more can be done to keep costs down by stopping projects that aren’t delivering value.

The LTP expects that Council’s net debt will increase to $1.8b by the end of 2024/2025 and $2.6b by 2033/34. We do not believe that the Council’s has set out a sufficiently clear plan for keeping debt below the cap in the medium-term and falling in the longer-term so ratepayers aren’t saddled with high debt servicing costs well into the future.

While some projects have been delayed or cancelled (Khandallah Pool, Hutt Road upgrades, skate park upgrades, annual fireworks etc) the plan clearly does not go far enough to keep Council’s debt under control. The Chamber supports the Council’s decision to cancel these projects or close services where they do not demonstrate value for money.

The result of continuing activities as they are, is that the proposed 18%2 rate rise will hit business hard, with a considerable impact on small and independent businesses. Business has choices, not only within the region but globally.

If there is one thing to be aware of, it is that the revenue from business that drives the city is the only way Council meets the aspirations of this LTP and other plans. Declining business confidence and revenue or accelerating business closures can be the bellwether of a snowball effect that builds upon itself becoming larger graver and disastrous as the city economy atrophies.

The cost-of-living crisis means businesses already face increased costs, staff challenges, high interest rates and decreasing consumer spending. Small, independent businesses are part of what makes Wellington unique, and the rates rise will be unaffordable for many on top of already increasing costs. Similarly, the increases will cause a drag on investment by larger businesses, with them needing to find more free available cash to pay rates for the same or declining services.

There are some simple improvements that can be made that will support the effective delivery of the Council’s objectives over the next 10 years. As said, based on what is in the LTP, there is a strong case for business to be an enthusiastic supporter of this Council and its agenda. However, a reset of the relationship is required. The Chamber urges the Council to consider how it can more successfully partner with business to bring about the thriving city that we all want. Currently business perspectives and priorities are not incorporated into decision-making, this is reflected in a LTP which doesn’t meet business needs or present value for our rates. There is no accountability structure for the 44% of the ratepayer base that funds the Council. To illustrate: $721,438 of the $1,639,633 remuneration pool for councillors is paid for by businesses.

Council will blow out its debt in this period

The financial commentary accompanying the main LTP notes that significant increases in construction costs, the scope of works being undertaken and the size of the Council’s capital expenditure programme mean that the Council is expected to exceed its own debt to revenue limit in this LTP period. This should be highlighted to the public.

There is one thing within the Council control here which is the size of the capital expenditure programme. We encourage Council to revisit this urgently because the reality is that expenditure will be looked at in due course with much closer scrutiny.

Kicking the can down the road: Deferral of renewal spending

The Long-term Plan capital expenditure programme includes only a proportion of the required renewal investment for our infrastructure based on our asset planning. This will result in some assets not being renewed at the time they should be. This is a 10-year decision, with a need for a catch up to happen over years 11–20 of the asset management plans.

The LTP says that in Transport, Property, Housing and other community assets the Council is planning to defer 25 percent of the renewals. We need to understand the real costs of these decisions both financially and in terms of the future condition and value of these assets, as well as future costs to restore the deferrals. This is not a statement without significant implications.

If Transport, Property, Housing are being degraded and sacrificed for cycleways and discretionary projects the public should know what impact this will have on the city in cost and the risk to quality of life and wellbeing. And who might be at risk and not helped financially, in terms of climate change and in terms of safe and liveable housing?

In summary

We are deeply disappointed the Council has backtracked on its proposal to reduce the commercial rates differential to 3.25. The differential is a city growth tax which is arbitrary and without solid public policy rationale. It is inefficient and gouges businesses. Worse still, it is being maintained at 3.7 during recessionary conditions. This decision is also reneging on an historic accord with the Chamber which included a commitment to reduce the differential over time. We may seek to reopen this issue. The differential has never been reported on or demonstrate to the benefit to business of its egregiously large contribution. When businesses thrive, Wellington thrives. But high commercial rates punish business – depressing employment and driving our city’s GDP down.

As a principle, we do not understand the ongoing justification for the rates differentials given that businesses do not receive additional services for that outlay, and there is growing evidence that rates differentials negatively impact on commercial investment and play into decisions on where businesses should be based due to their impact on overall rates bills.

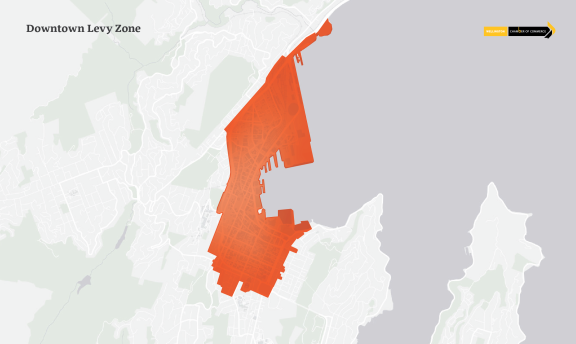

We have repeatedly submitted concerns about the application of the Downtown Levy and it must now be engaged. Businesses do not see evidence they are receiving value for money or transparency about how the levy is applied. We present a number of options for how business could be more involved and some considerations for how funding could be spent. Precedents exist for doing this and doing it well; Auckland’s Heart of the City is an example.

Business wants more involvement and certainty in key decisions that affect us. We have repeatedly asked for more of a partnership model and the Business Advisory Group we have hoped to establish has never been finalised.

We have major concerns about the impact of on-going construction on Thorndon Quay and planned in the Golden Mile. Council needs to consider the impacts on business, and provide clear plans to provide certainty. We have not heard from the Council on transport matters such as the Golden Mile, notwithstanding agreements with central government to do so. We are calling for better engagement with businesses to understand their perspective, rather than dismissing businesses views. Many decisions are made on feedback from individuals who may or may not be ratepayers or even be directly impacted by the decisions.

The Chamber supports the objective to make Wellington a liveable and accessible, compact city but cycleways – while part of the mix - are not the only answer. We support a more measured approach to cycleways that provide greater certainty to business with more understanding of the negative impacts and disruptions caused, especially when considering the not insignificant contribution to rates increases.

The Chamber have previously urged the Council to investigate options to further diversify its revenue streams. We are supportive of the progress in identifying diversified revenue streams including:

funding the new waste services through a user-pays targeted levy

introducing new categories for development contributions to reflect different network infrastructure demands and costs

the sale of the Council’s shareholding in the airport.

We continue to urge the Council to seek further revenue streams focussed on the user-pays principle such as the introduction of water meters as outlined in the LTP.

The Chamber is supportive of the Council’s proposal to sell its airport shares and invest the proceeds in a Perpetual Investment Fund (PIF), however, we do not support this unless targeted legislation to set up and govern the PIF. Legislation will ensure the original intended use of the funds is preserved and provide appropriate safeguards.

The Chamber would be interested in further discussions about how the PIF could be used to support economic development and business innovation in Wellington.

The proposed rates increase is significant

Including the Sludge Levy, the proposed rates increase for Wellington is 18%. This is a significant increase – both higher than the national average rates increase of 15% identified by LGNZ and higher than cities we need to be comparing ourselves to. In comparison Auckland City Council’s proposed rates increase is a much more manageable 7.5%.

The proposed 18% rate rise will hit business hard, with a considerable impact on small and independent businesses. The cost-of-living crisis means businesses already face increased costs, staffing challenges, high interest rates and decreasing consumer spending. Small, independent businesses are part of what makes Wellington unique, and the rates rise will be unaffordable for many on top of already increasing costs. The increases will cause a drag on investment by larger businesses, with them needing to find more free available cash to pay rates for the same or declining services.

We understand why the rates increase is so high, and we note that the financial projections demonstrate these rates will stay egregiously high, but we urge Council to maintain a clear focus on prudent financial management, demonstrating value for money and investing in projects that will create lasting change for Wellington, rather than pet projects.

In particular, we believe there is more work to be done to look at what could be stopped. We support initiatives such as closing the Khandallah pool. This type of thinking needs to be taken to all initiatives. The rates rises and debt position of the Council are symptoms of the bigger issue, which is the need to address the economic model for funding of local government. The Chamber has consistently supported these discussions and the offer stands to become involved.

Council needs to value business perspectives

There is resounding understanding from business of the need for significant investment in Wellington’s infrastructure. Businesses want to help this city succeed - they are passionate about Wellington and believe that we can regain our status as a world-leading capital.

Currently, Wellington businesses feel that our city is synonymous with bureaucracy and politics rather than business and innovation. We want to see a clear plan from Council as to how business perspectives and priorities will be incorporated into planning and decision-making. Central businesses have been heavily impacted by construction projects on Thorndon Quay, and the Golden Mile, despite pleas to Council these projects continue to progress with no clear timeframes for completion. Without certainty businesses cannot plan for how they will weather difficult times.

The Council needs to commit to valuing business voices and concerns. Businesses pay 44% of Wellington’s rates (despite owning only 15% of Wellington’s property value), but they do not feel they are receiving a good return on investment or an opportunity to shape how rates are applied.

“There is no weighting of business into Council’s decision making, even when they consult they say they will take in on board but they just do their own thing.”

CEO of Wellington Business

“Council doesn’t think in partnership with business.”

CEO in the Hospitality Industry

The Chamber urges the Council to remain focused on ensuring that ratepayers see value for money from their rates. This includes ensuring that there is a clear connection between the justification and target of specific rates and increasing levels of transparency and accountability. An example where the business community feels ignored is in the insistence on cycleways as the only option to make Wellington a liveable and accessible city. The Chamber supports the objective of making Wellington a liveable and accessible compact city but believe that cycle ways are not the only way of achieving this and that Council is deliberately dismissing business perspectives in favour of ‘general support’ sentiments from individuals on Cuba Street that do not have to live with the impact or pay for it.

The Council needs to do better at listening to business, at giving more complete information to businesses for them to understand the scale and duration of the disruption to allow them to plan, and to explore and implement strategies to mitigate disruption.

As Council is aware, since the 2021 Long Term Plan consultation3 there has never been a survey of ratepayers, residents, or the public about:

Costs and levels of expenditure

Cost/benefit (such as BCR) of the cycle project(s) in which the views on costs were as a relevant consideration in a decision.

Public satisfaction on cycleways outcomes

Public view of the priorities among modes of transport

Appropriate levels of expenditure per mode of transport.

Rates differential

We are disappointed to see that the Council has backtracked on its proposal to reduce the commercial differential from 3.7 to 3.25 from July next year. The differential is the highest in the country, and leads to Wellington businesses paying a disproportionate amount of rates compared to other similar cities.

We felt that this reduction sent a message to business that the Council is listening to their concerns, and recognising the considerable commercial pressures they are currently facing. The business community are extremely disappointed by the proposal to retain the business differential at 3.7. This feels like another example of the Council choosing not to listen to the concerns of the business community.

We understand that a concern for the Council is the significance of rates rises proposed across the board and the ability of residential ratepayers to meet their obligations. However, we urge the Council to reconsider the commercial rates differential and set out a long-term plan which sees the commercial differential falling over time.

Following on from our submission on the Rating Policy, we point you to the analysis of Wellington-based economic consultants, Sense Partners about the impact of commercial rates on the local economy. Their independent report Tax and the city – a closer look at the business differential and land taxation commissioned by the Chamber, is attached as an annex.

The analysis by Sense Partners supports our position that a high business differential decreases employment, and reduces income for workers. The model developed by Sense Partners suggests that decreasing the business differential by 1% would boost employment by a little under 0.1%; decreasing the differential by 50% would increase employment by about 4%. But it’s not only the level of employment that’s impacted – a lower differential would supply productivity improvements to deliver an additional $185.83 of income for incumbent workers each year. Overall, a lower differential could induce a $29.3 million increase in city-wide GDP for Wellington.

Downtown Levy

We have repeatedly submitted concerns around the use of the Downtown Levy funds. While we are not necessarily opposed to the use of targeted rates, there must be a clear purpose for the rate, a connection to the activities it funds and transparency on how the money is spent.

The Downtown levy’s initial purpose was to subside free parking in the city, and the resulting rates revenue was administered separately from other Council activities. There was a clear justification for a targeted levy with the impact of free parking clearly correlated with downtown businesses. However, since free parking ended in 2008, the application of the downtown levy has focused solely on “tourism promotion”. The Long-Term plan proposes the levy to be set to pay for:

50% of the costs of WREDA and Venues activities

40% of the costs of Wellington Convention Centre activity

70% of the visitor attractions activity

25% of galleries and museums activity.

Downtown businesses don’t believe that these activities produce distinct benefits for their businesses that justify a specific targeted levy. At the same time, city centre retailers are facing particularly challenging conditions as workers and shoppers increasing opt to spend their time and money in the suburbs. We urge the Council to commit to working with downtown retailers to ensure the funds are spent in ways that support city centre business growth and development.

We have previously submitted that the Council should establish a dedicated business representative to work alongside business on the application of these funds. We pointed to the example of Dublin, where the introduction of a business representative was extremely successful in central city revitalisation. Another option would be to follow the example of Napier and Christchurch City Councils. Both Councils collect a city levy which is then contributed to a business-led associations4 for application on activities to promote the central city. This gives business a greater voice and control over the rates contributions and utilises business understanding of what is needed for a thriving city centre.

We have spoken to some of our members about how they would like to see the Downtown Levy spent. Unprompted suggestions from members included:

Security and lighting in the Courtenay/Cuba precinct

Street activations across the CBD

Supporting activities such as live music, shows, mid-sized events, sporting festivals and national competitions.

We have also repeatedly asked for specific information about the application of the Downtown levy funds and the impact of these activities on the businesses that pay the levy. We have never had a fulsome response. The use of percentages (rather than actual amounts) to demonstrate where the Levy spent is a further example of the lack of transparency. We urge the Council to consider greater transparency on the application of the funds – as a comparison the Auckland City Centre targeted rate is reported on annually, with publicly available information on how rates were applied, and how the rates will be applied in the coming year.

Alternative methods of raising revenue

The Chamber echoes the advice from the Citizens’ Assembly that the Council needs to explore alternative methods of raising revenue. The continued reliance on differential or targeted rates is not financially sustainable. The Council needs to rely on a range of tools, that either more directly target the users of services or share costs more equitably.

In our submission on the Council’s Rating Policy we urged the Council to consider four specific types of alternative revenue streams

Increased user charges (such as for use of water and waste-water)

Better aligning development contributions to the context and cost of services

Increasing the use of Special Purpose Vehicles for specific infrastructure projects

Divesting commercial businesses.

Increased user charges

We understand, in some situations, there can be practical challenges in determining how to set user charges or pass them on to users. But there is also a clear category of services where user charges are easily calculated and applied. As an example, we are supportive of the proposal to fund a new residential waste collection service through a targeted rate on residential properties. This is a clear application of user charges which we would support in a larger range of circumstances.

Another area where user charges could be applied is by investing in water meters. As an interim measures Council should consider introducing water meters, with user charges to be introduced incrementally. Additionally, water meters have been shown to promote water conservation by making users more aware of user costs which is particularly important given Wellington’s summer water constraints.

Better alignment of development contributions

The Chamber is supportive of the Council’s introduction of additional categories to Development Contributions in order to reflect the different network infrastructure demands (and costs) generated.

Sale of airport shares

As we have expressed in the past, the Chamber is supportive of the proposal to sell the Council’s minority shareholding in the Wellington airport. We are in agreement that the sale will positively diversify the Council’s investment portfolio and manage insurance risks and therefore support the sale of all the Council’s shares (Option A). We also support the creation of a Perpetual Investment Fund (PIF), rather than using the proceeds to pay down debt or finance other Council projects.

Management of the PIF

We strongly recommend the use of targeted legislation to set up and govern the PIF, such as was enacted for the New Plymouth District Council’s PIF. The decision to sell the airport shares is significant and will generate a significant amount of public debate and concern. The proceeds of the sale will also be substantial. Given this, we strongly feel it is appropriate to use legislation to govern the PIF, as this will ensure the original intended of the use of funds is preserved and provide appropriate safeguards.

The New Plymouth District Council (Perpetual Investment Fund) Act 2022 sets out the principles for managing and applying the fund and guidance for investment decisions. This includes requirements that investment decisions must be made on a prudent, commercial basis in a manner that is best practice portfolio management, maximising return without undue risk to the PIF as a whole and avoiding prejudice to the reputations of the Council and the community. Since 2017, the PIF has been managed by independent investment firm Mercer which gives further assurance about the prudent commercial management of funds. Having these safeguards set out in legislation is important for accountability and transparency given the considerable sum which would be held by the PIF.

Purpose of the PIF

The creation of legislation would also allow for robust debate around the purposes of the PIF and how the funds will be applied. We note the LTP proposes that the Council will set out a strategy with parameters for how the fund works but “current assumption is that the fund will have an investment focus on environmental, social and governance factors, subject to further advice from an investment manager."

In contrast the Finance Policy states that the purposes of the fund will be to:

Make funds available in the event of a significant natural disaster

Enable the Council to pursue ‘other objectives’ e.g. Environmental, Social and Governance factors can be taken into account when making investment decisions

Maintaining financial return for Council through dividends and interest

Improve intergenerational wellbeing through the buildup of investment wealth and reduce reliance on future rates increases.

These purposes are wide and could see funds used for a variety of purposes. In particular ‘other objectives’ is an extremely wide purpose which we urge the Council to publicly consult, engage with business on and define further.

The Chamber would be interested in further discussions about how the PIF could be used to support economic development and business innovation in Wellington. With the support, expertise and knowledge of the business community, the PIF could play an important role in investing to enable business growth and innovation.

Advocating for change in funding and financing for local government

The Chamber supports the Council’s plan to work collaboratively with other councils and central government to provide a sustainable funding model for local government.

The Chamber notes the lack of focus on housing in the LTP. One of the priorities of the 2021 LTP was a focus on affordable, resilient, and safe housing. While a number of projects have been completed in this year, there is still significant work to be completed before this objective has been achieved. Greater transparency on how we will achieve important housing objectives would be preferable.

Other options to tighten the purse strings

As the Chamber has previously outlined, we believe that there is a strong case for the Council to explore sharing services and some back-office functions with neighbouring councils to bring down costs. Council should transition towards the phased amalgamation of back-office functions and public services across Wellington, Porirua and Hutt Councils over time. This process has already begun in some areas behind the scenes but needs to pick up pace. Local authorities overseas have found that sharing services can unlock significant savings – in the UK, it’s estimated around £200m (c. $400m) is saved annually by local authorities through pooling services.5 Councils in Australia have also realised multi-million-dollar savings from sharing services such as IT and procurement.6 There are a range of approaches to sharing services, from pooling back-office functions like finance and HR, through to sharing leadership teams across a region. We have previously called on the Council to kick-start a discussion on amalgamation across the Wellington region and explore a range of options that could unlock savings for ratepayers. We were disappointed to see the LTP made no mention of the potential to reduce costs in this way, particularly given the extent of rate rises proposed.

We support initiatives to merge water functions with other councils that has been recently reported in the media.

Concerns about the Council’s level of debt

Debt at the Council is a major concern for the Chamber. The LTP expects that Council’s net debt will increase to $1.8b by the end of 2024/2025 and $2.6b by 2033/34. We do not believe that the Council’s has set out a sufficiently clear plan for keeping debt below the cap in the medium-term and falling in the longer-term so ratepayers aren’t saddled with high debt servicing costs well into the future. While some projects have been delayed or cancelled (Khandallah Pool, Hutt Road upgrades, skate park upgrades, annual fireworks etc) the plan clearly does not go far enough to keep Council’s debt under control. The Chamber supports the Council’s decision to cancel these projects or close services where they do not demonstrate value for money or only benefit a small community but has disproportionate associated costs paid for by other rate payers.

General Observation about the consultation

The Council approach to is consultation is to disaggregate documentation. What we mean by this is that the documentation is separated out and has become difficult to read together and to cross reference. This in turn risks creating a main ‘cheerleader document’ with a positive and optimistic presentation of the components of the plan, supported by much more realistic data housed elsewhere.

The need to read these various documents together to truly understand the costs, risks and opportunities in the LTP is imperative but difficult. We must keep in mind what the ratepayer as funder would ultimately want to know, for example:

The major risks and the matters that might be top of mind for ratepayers

25% deferral of spending on property, housing and transport

The relationship between certain projects and their impact on debt

The impact of rate rises in real dollar terms on housing at certain price points

The costs of projects relative to their impact on the budget and debt

Return on investment in projects versus those that should be explained.

And the list goes on.

The Council is not alone in creating LTP documents this way. It is an extraordinarily complicated task to pull these documents into any order, but at what point is the information so separated and uncorrelated that is it is actually not useful, to an ordinary reasonable ratepayer, to attain its goal.

Commitment to democracy

There are several local government elections between the LTP of today and 2034.

The voter return in the recent by-election in 2024 was 25.47% or 8644 votes. No member of a Council can consider that 25% of eligible voters is a mandate. Irrespective of position on the Māori ward system, 33% of people enrolled in the Māori ward voted.

If voter turnout continues to trend this way the legitimacy of Councillors themselves as decision makers could be undermined by non-democratic entities hostile to the state. We encourage the Council to reserve funds to commission an independent agency to put together an equitable, fair campaign for ratepayers (who pay for the Council) to encourage them to vote and educate them on the importance of the vote.

Thank for you taking the time to review our submission on the Long-Term Plan. We strongly urge the Council to consider our recommendations which we believe will unlock economic growth and opportunities for Wellington.

In summary the Chamber urges the Council to:

Commit to a new approach to valuing the perspectives and priorities of the business community. Businesses have lots of ideas for how to improve Wellington, and given we pay 44% of rates, we deserve to have a meaningful say.

Set out a plan for reducing the commercial rates differential. When business thrives, Wellington thrives.

Review the Downtown Levy to ensure there is greater transparency on its use, and produces value for downtown rate payers.

Key Proposal 1 – Investing in our three waters network: the chamber support the preferred option 3 for the full investment, but believes this needs to be coupled with more rigour in other areas where spending can be pared back or deferred.

Key Proposal 2 – waste collection: the Chamber supports the preferred option to fund the new waste services through a user-pays targeted levy as an equitable approach

Key Proposal 3 – sale of the airport shares: The Chamber supports the Council’s preferred option to sell all of its airport shares and invest the proceeds in a Perpetual Investment Fund (PIF), however, we only support this if targeted legislation is set up to govern the PIF. Legislation will ensure the original intended use of the funds is preserved and provide appropriate safeguards

Continue to explore options for reducing costs and alternative methods for raising revenue.